The Supreme Court on Thursday issued notices to political parties, the federal government, Attorney General for Pakistan (AGP) Mansoor Awan, Pakistan Bar Council (PBC), the Supreme Court Bar Association of Pakistan and other respondents in the case pertaining to the SC Practice and Procedure Bill 2023.

After hearing the arguments from the petitioners, the SC adjourned the case till next week.

The case was heard by a eight-member bench of the Supreme Court which took up three petitions challenging the SC Practice and Procedure Bill 2023.

The bench, formed other day, was headed by the CJP and comprised of Justice Ijazul Ahsan, Justice Munib Akhtar, Justice Sayyed Mazahar Ali Akbar Naqvi, Justice Mohammad Ali Mazhar, Justice Ayesha A. Malik, Justice Syed Hasan Azhar Rizvi and Justice Shahid Waheed.

During the today’s proceedings, the CJP remarked that the apex court would have to examine whether the bill in question violated the Constitution.

The CJP said the independence of judiciary was paramount, but at the same time he had utmost respect for the Parliament.

Earlier in the day, the coalition government issued a joint statement and rejected the SC bench hearing the petition against the bill which was meant to limit the CJP’s powers regarding suo motu notices and constitution of the SC benches.

The bill, at the first place, was passed by both the National Assembly and Senate which then sent to President Dr Arif Alvi who returned the proposed legislation with some reservations.

The president said the law travelled beyond the competence of the Parliament.

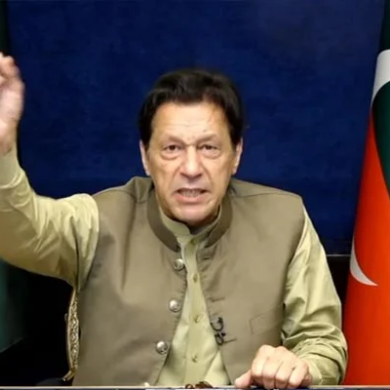

On Monday, the bill was passed by a joint sitting of parliament with certain amendments, amid a noisy protest from PTI lawmakers.

Today, the National Assembly has also passed a resolution which called for dissolution of the SC’s larger bench hearing a set of petitions challenging the bill.